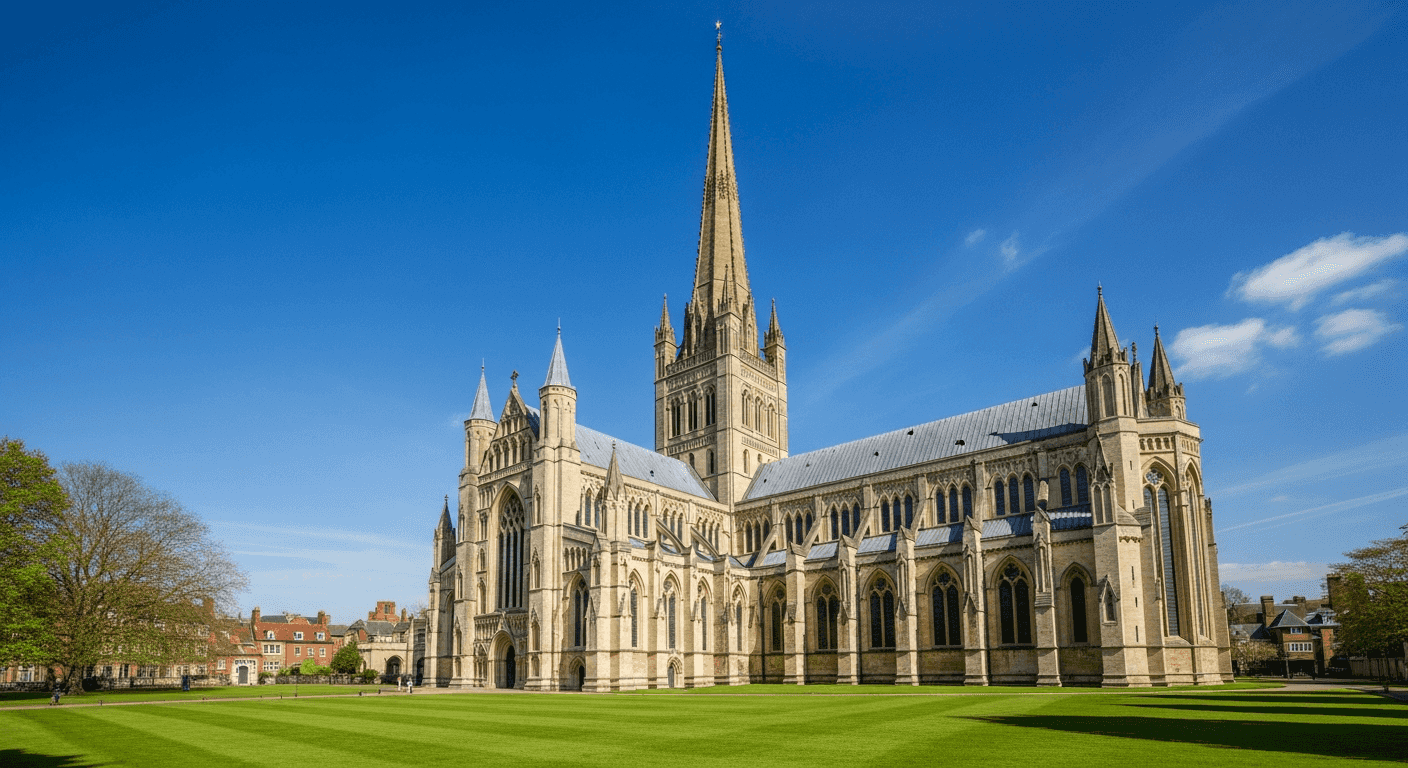

Your Local Mortgage Experts in Norwich

As specialist mortgage advisers serving Norwich and Norfolk, we understand the local property market inside out. From the Victorian terraces of the Golden Triangle to the family homes of Eaton, we help clients across the region find the right mortgage for their circumstances.

Norwich is a fine city with a unique mix of historic architecture, strong employment base, and excellent quality of life. Our whole-of-market access means we can search over 100 lenders to find you the best deal—whether you're buying your first home near the city centre or expanding your portfolio in the suburbs.

Why local knowledge matters

Norwich's property market is diverse — from city-centre flats to family homes across Golden Triangle, Eaton, Thorpe St Andrew and Cringleford. We regularly help clients with complex situations, including bad credit, self-employed income, and non-standard properties — matching them with lenders who understand the local market rather than relying on automated systems.

Our Mortgage Services in Norwich

Step onto the Norwich property ladder with expert guidance. From the Golden Triangle to Thorpe, we help first-time buyers across Norfolk.

Norwich's strong rental market driven by UEA and Aviva offers excellent yields. We help landlords find competitive rates.

Declined elsewhere? We specialise in complex cases and help Norwich residents secure mortgages despite credit issues.

Norwich has a thriving creative and insurance sector. We understand contractor, freelancer, and company director income structures.

Why Choose Us?

Rated excellent by clients nationwide on Reviews.io

Full protection and professional standards guaranteed

We search 100+ lenders to find your best rate

Phone appointments and evening slots available

Areas We Cover in Norwich

We provide mortgage advice to clients across Norwich and the surrounding areas, including:

Frequently Asked Questions - Norwich Mortgages

We Also Serve Nearby Cities

Looking for mortgage advice in other areas? We provide the same expert service across the East of England:

People Also Ask About Mortgages in Norwich

Norwich Property Market Overview

£275,000

Average Property Price

Popular Property Types

Victorian terraces, Georgian townhouses, 1930s semis, modern developments

5-7%

Typical Rental Yield

Key Areas to Consider

Golden Triangle: £300,000-£500,000 - Victorian terraces, near UEA, professional families, cafes and restaurants. Eaton & Cringleford: £350,000-£550,000 - Sought-after suburbs, excellent schools. Thorpe St Andrew: £280,000-£450,000 - Riverside location, good amenities. City Centre: £180,000-£350,000 - Historic buildings, young professionals, investment flats.

Norwich is known as a 'fine city' with a medieval centre, vibrant cultural scene, and strong economy. Major employers include Aviva (UK headquarters), Norfolk and Norwich University Hospital, and the University of East Anglia. The city offers excellent value compared to Cambridge and London, with strong rental demand and good quality of life.

Verified Client Reviews

Independently authenticated via Reviews.io. Only real clients can leave feedback.

Loading verified client reviews...

We help clients across Norwich and Norfolk — including first-time buyers, self-employed applicants, and those previously declined elsewhere.

Ready to Get Started?

Book your free, no-obligation consultation with our Norwich mortgage specialists. We offer flexible appointments including video calls and evening slots.